Unlocking Financial Success with Bookkeeping and Accounting Services

In today’s fast-paced business environment, having reliable bookkeeping and accounting services is crucial for success. Companies, regardless of size and industry, must maintain accurate financial records, comply with regulations, and make informed decisions based on precise data. At Booksla.com, we provide comprehensive financial solutions designed to cater to your unique business needs.

Understanding Bookkeeping vs. Accounting

Before diving deeper, it's important to differentiate between bookkeeping and accounting, as both play pivotal roles in financial management.

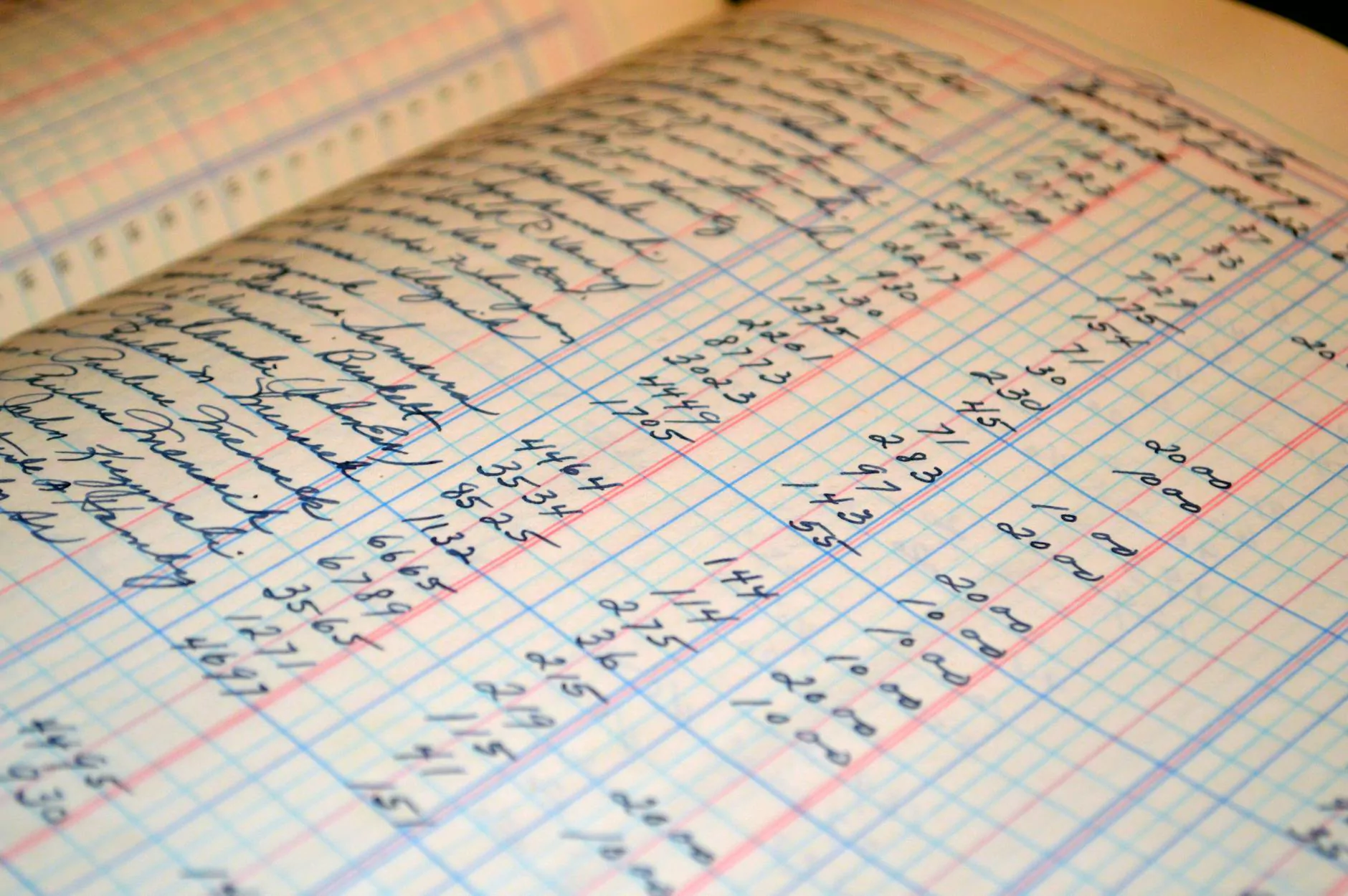

- Bookkeeping involves the systematic recording of financial transactions. This includes purchases, sales, receipts, and payments, ensuring that all financial data is organized.

- Accounting, on the other hand, encompasses the interpretation, classification, analysis, reporting, and summarization of financial data. It provides insights that help businesses make strategic decisions.

The Importance of Professional Bookkeeping Services

Many business owners believe that they can handle their own bookkeeping. However, the complexities involved can lead to errors that may have detrimental effects. Here’s why opting for professional bookkeeping and accounting services is advantageous:

- Accuracy: Professional bookkeepers are trained to spot errors and discrepancies, ensuring your books are 100% accurate.

- Time-Saving: Outsourcing your bookkeeping allows you to focus on your core business activities, enhancing productivity.

- Compliance: Professionals stay abreast of tax laws and regulations, so your business remains compliant and avoids legal issues.

- Financial Insights: Bookkeepers can produce regular financial reports, giving you insights to make informed business decisions.

Tailored Accounting Solutions for All Businesses

No two businesses are the same, and that’s why Booksla offers tailored accounting solutions that fit perfectly with your business model. Here’s what you can expect:

1. Comprehensive Financial Reporting

Our team offers detailed financial reporting that gives you a clear picture of your business's performance. This includes:

- Profit and Loss Statements

- Balance Sheets

- Cash Flow Statements

2. Tax Preparation and Planning

Rather than dread tax season, let our accountants handle the complexities of tax regulations. We offer:

- Year-round tax planning

- Preparation of tax returns

- Strategies to minimize tax liabilities

3. Payroll Management

Accurate payroll is critical for employee satisfaction and retention. Our payroll services include:

- Payroll calculations

- Tax withholdings

- Employee benefit management

Embracing Technology in Bookkeeping and Accounting

At Booksla, we leverage the latest technology and software solutions to enhance our bookkeeping and accounting services. This not only increases efficiency but also provides you access to real-time financial data.

Cloud-Based Solutions

We utilize cloud accounting software which allows you to access your financial information anytime, anywhere. Benefits include:

- Secure access to data

- Automated updates and backups

- Collaboration with your financial team via shared access

Choosing the Right Bookkeeping and Accounting Partner

Selecting the right partner for your financial management is vital. Here are some factors to consider:

- Experience: Look for service providers who have a proven track record and extensive experience in your industry.

- Services Offered: Ensure they offer a comprehensive range of services that meet your needs.

- Client Testimonials: Positive feedback from other businesses can provide insights into their reliability and customer service.

The Benefits of Outsourcing Bookkeeping and Accounting

Outsourcing your financial management comes with numerous benefits:

- Cost-Effective: Save on overhead costs associated with hiring in-house staff.

- Access to Expertise: Gain insights from experienced professionals who can provide guidance on financial strategies.

- Focus on Core Business: Allow your team to concentrate on what they do best, which is running the business.

Common Financial Mistakes Small Businesses Make

Understanding common financial pitfalls can help you avoid them:

- Poor Tracking: Failure to keep accurate records often leads to compliance issues and tax problems.

- Neglecting Cash Flow Management: Cash flow is the lifeblood of any business; without proper management, you can face dire consequences.

- Ignoring Professional Help: Many small business owners underestimate the importance of professional bookkeeping and accounting services until it’s too late.

Conclusion

In conclusion, partnering with a reliable provider of bookkeeping and accounting services not only helps ensure your business remains compliant but also enables you to make informed decisions that drive growth and success. At Booksla.com, we pride ourselves on offering tailored solutions to meet the unique needs of our clients. The time to take control of your financial future is now. Let us enhance your financial management, so you can focus on what matters most – your business growth!